Posts Tagged venture-capital

Bridging the Gap: Investor – Startup Psychology and What VCs Really Want to Hear

Posted by Bill Storage in Innovation management, Strategy on December 11, 2025

There’s a persistent gap between what investors want to know about startups and what founders present during their pitches. You’ll significantly improve your chance of being funded if you understand investors’ perspective and speak directly to their interests.

I speak with a bit of experience, having been on both sides of the investor conversation. Early in my career, I conducted technology due diligence for Internet Capital Group (ICG) and have since represented VC interests for $20-40M A rounds. I was also twice in the founder’s shoes, successfully raising capital for my own startups, including a $2 million round in 1998, a decent sum back then. The dynamics of pitching evolve, but the core investor psychology remains constant.

Thousands of articles list the top n things to do or not do while pitching. Here I take a more data-driven approach, grounded in investor psychology. By analyzing data on how investors consume pitch decks versus what founders emphasize in live presentations, startups can tune their pitches to align with audience interest and mental biases.

10 Essential Pitch Topics

Fifteen years ago, Sequoia Capital authored their seminal Guide to Pitching. It identified ten primary topics for a startup pitch deck, each to be covered in one or more slides:

- Purpose

- Problem

- Solution

- Why now?

- Market

- Competition

- Business model

- Team

- Financials

- Product

The Shifting Attention Span of Investors

I collected data on where founders spend their time during live pitches from the Silicon Valley Software SIG, videos of pitches found on the web, Band of Angels, and live pitch competitions in the bay area over the last ten years.

I also started tracking DocSend’s data on investors’ pitch deck interest. Their data consistently shows that the average time investors spend reviewing a pitch deck is very brief. The average time dropped from 3 minutes and 27 seconds in 2015 to just 2 minutes and 47 seconds by April 2021. The most recent data from 2024 shows an even tighter window, often averaging just 2 minutes and 35 seconds. Investors are smart, busy, and focused, so pitch decks must cover the right topics clearly and efficiently.

The Persistent Mismatch of Interests

The count of slides in a deck has averaged around 20 for years. Using that as a guide, at least one slide should cover each of the primary Sequoia topics, with some topics needing more real estate.

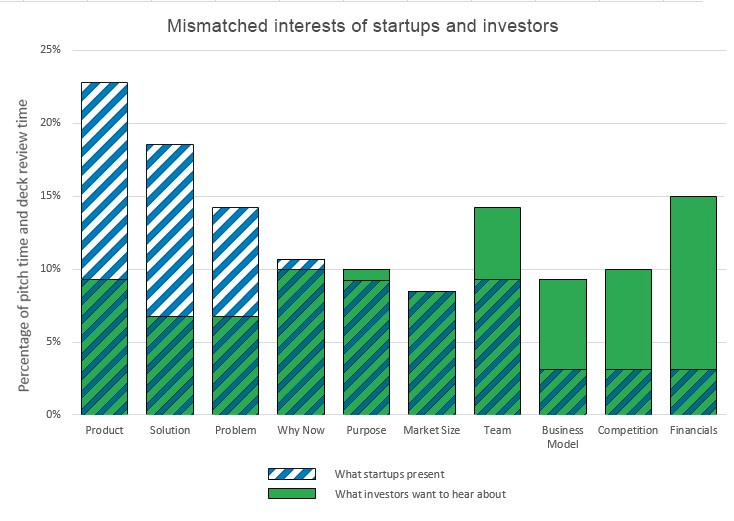

The combined data on investor viewing time versus founder presentation time reveals a clear mismatch of interest (see chart). From the investor’s perspective, founders still talk far too much about the problem, the solution, and how the product delivers the solution. Conversely, founders talk far too little about the business model, the competition, and financials.

This mismatch highlights something that may seem obvious but is too easily lost in the pursuit of developing great technology: Investors want to know how their money will translate into your growth and their eventual profitable exit. Ultimately, they want to manage their investment risk.

A Great Product Does Not Guarantee a Great Investment

Investors often need little convincing that a business problem exists and that your product is a potential solution. They trust your domain expertise on the problem. But a great product does not necessarily make a great company, and a great company is not necessarily a great investment.

To judge an investment risk as acceptable, investors need to understand your business model in detail.

- How exactly do you get paid for your product?

- What are your primary channels for customer acquisition?

- How much will it cost to acquire each new customer (CAC)?

They want to know that your sales forecasts are plausible. What size of sales force will it take if you’re projecting exponential sales increases?

Competition and Market Realities

Data presented by Ron Weissman at Band of Angels back in 2015 showed that founders gave almost no time at all to their competition. While this has improved slightly, it remains a significant weak area for most pitches.

You should be able to answer key competitive questions transparently:

- Who are your competitors now?

- Who will they be in the future?

- What is their secret sauce?

- What do you do better than all of them?

- Can you maintain that advantage in the future?

You should answer these questions without disparaging your competitors or resorting to the classic red flag that “there are no competitors” (which usually implies there is no market). Differentiation should include aspects of the business – such as distribution, partnerships, or unique data access – not just technical product features.

Focus on Scalability and Use of Funds

Investors are rarely interested in science projects. They want to see a business that can scale rapidly with an injection of capital. Your financial projections must make clear your intended use of funds.

- How much goes to hiring great talent?

- How much to marketing?

- How much to sales?

Investors understand that your projections of future revenue, market share, and customer acquisition costs are hypothetical and based on limited current information. However, they are scrutinizing your ability to think critically about scale. They want proof that it is feasible you’ll reach the key metrics required for your next round of funding before you run out of money.

This emphasis on feasibility and risk mitigation translates directly into a heightened focus on capital efficiency. In today’s market, VCs prioritize companies that can do more with less. Pitches need to clearly articulate a path to profitability or sustainable growth that minimizes cash burn. Investors want to see that founders have a credible plan to achieve significant milestones within 18-24 months without needing another immediate cash infusion. Demonstrating a capital-efficient operational plan is now as critical as projecting believable revenue growth.

I hope you find this material helpful for tuning your pitch deck to its investor audience. Please let me know if I can develop any of these points further.

Recent Comments