Posts Tagged startups

Bridging the Gap: Investor – Startup Psychology and What VCs Really Want to Hear

Posted by Bill Storage in Innovation management, Strategy on December 11, 2025

There’s a persistent gap between what investors want to know about startups and what founders present during their pitches. You’ll significantly improve your chance of being funded if you understand investors’ perspective and speak directly to their interests.

I speak with a bit of experience, having been on both sides of the investor conversation. Early in my career, I conducted technology due diligence for Internet Capital Group (ICG) and have since represented VC interests for $20-40M A rounds. I was also twice in the founder’s shoes, successfully raising capital for my own startups, including a $2 million round in 1998, a decent sum back then. The dynamics of pitching evolve, but the core investor psychology remains constant.

Thousands of articles list the top n things to do or not do while pitching. Here I take a more data-driven approach, grounded in investor psychology. By analyzing data on how investors consume pitch decks versus what founders emphasize in live presentations, startups can tune their pitches to align with audience interest and mental biases.

10 Essential Pitch Topics

Fifteen years ago, Sequoia Capital authored their seminal Guide to Pitching. It identified ten primary topics for a startup pitch deck, each to be covered in one or more slides:

- Purpose

- Problem

- Solution

- Why now?

- Market

- Competition

- Business model

- Team

- Financials

- Product

The Shifting Attention Span of Investors

I collected data on where founders spend their time during live pitches from the Silicon Valley Software SIG, videos of pitches found on the web, Band of Angels, and live pitch competitions in the bay area over the last ten years.

I also started tracking DocSend’s data on investors’ pitch deck interest. Their data consistently shows that the average time investors spend reviewing a pitch deck is very brief. The average time dropped from 3 minutes and 27 seconds in 2015 to just 2 minutes and 47 seconds by April 2021. The most recent data from 2024 shows an even tighter window, often averaging just 2 minutes and 35 seconds. Investors are smart, busy, and focused, so pitch decks must cover the right topics clearly and efficiently.

The Persistent Mismatch of Interests

The count of slides in a deck has averaged around 20 for years. Using that as a guide, at least one slide should cover each of the primary Sequoia topics, with some topics needing more real estate.

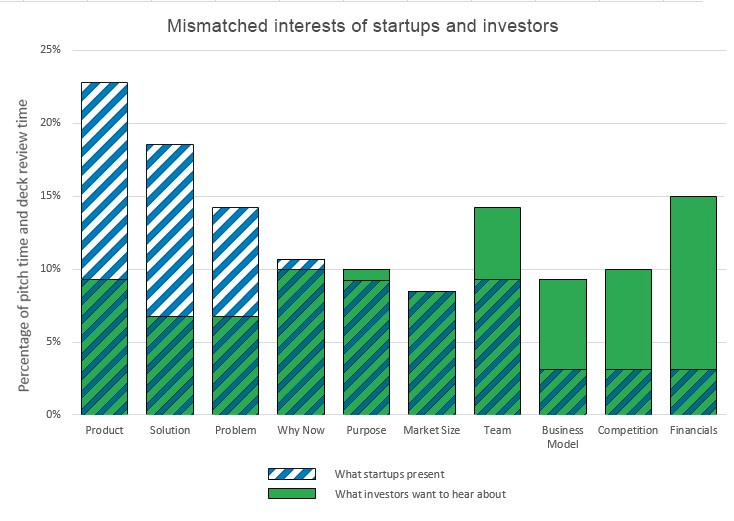

The combined data on investor viewing time versus founder presentation time reveals a clear mismatch of interest (see chart). From the investor’s perspective, founders still talk far too much about the problem, the solution, and how the product delivers the solution. Conversely, founders talk far too little about the business model, the competition, and financials.

This mismatch highlights something that may seem obvious but is too easily lost in the pursuit of developing great technology: Investors want to know how their money will translate into your growth and their eventual profitable exit. Ultimately, they want to manage their investment risk.

A Great Product Does Not Guarantee a Great Investment

Investors often need little convincing that a business problem exists and that your product is a potential solution. They trust your domain expertise on the problem. But a great product does not necessarily make a great company, and a great company is not necessarily a great investment.

To judge an investment risk as acceptable, investors need to understand your business model in detail.

- How exactly do you get paid for your product?

- What are your primary channels for customer acquisition?

- How much will it cost to acquire each new customer (CAC)?

They want to know that your sales forecasts are plausible. What size of sales force will it take if you’re projecting exponential sales increases?

Competition and Market Realities

Data presented by Ron Weissman at Band of Angels back in 2015 showed that founders gave almost no time at all to their competition. While this has improved slightly, it remains a significant weak area for most pitches.

You should be able to answer key competitive questions transparently:

- Who are your competitors now?

- Who will they be in the future?

- What is their secret sauce?

- What do you do better than all of them?

- Can you maintain that advantage in the future?

You should answer these questions without disparaging your competitors or resorting to the classic red flag that “there are no competitors” (which usually implies there is no market). Differentiation should include aspects of the business – such as distribution, partnerships, or unique data access – not just technical product features.

Focus on Scalability and Use of Funds

Investors are rarely interested in science projects. They want to see a business that can scale rapidly with an injection of capital. Your financial projections must make clear your intended use of funds.

- How much goes to hiring great talent?

- How much to marketing?

- How much to sales?

Investors understand that your projections of future revenue, market share, and customer acquisition costs are hypothetical and based on limited current information. However, they are scrutinizing your ability to think critically about scale. They want proof that it is feasible you’ll reach the key metrics required for your next round of funding before you run out of money.

This emphasis on feasibility and risk mitigation translates directly into a heightened focus on capital efficiency. In today’s market, VCs prioritize companies that can do more with less. Pitches need to clearly articulate a path to profitability or sustainable growth that minimizes cash burn. Investors want to see that founders have a credible plan to achieve significant milestones within 18-24 months without needing another immediate cash infusion. Demonstrating a capital-efficient operational plan is now as critical as projecting believable revenue growth.

I hope you find this material helpful for tuning your pitch deck to its investor audience. Please let me know if I can develop any of these points further.

Content Strategy Beyond the Core Use Case

Posted by Bill Storage in Strategy on June 27, 2025

Introduction

In 2022, we wrote, as consultants to a startup, a proposal for an article exploring how graph computing could be applied to Bulk Metallic Glass (BMG), a class of advanced materials with an unusual atomic structure and high combinatorial complexity. The post tied a scientific domain to the strengths of the client’s graph computing platform – in this case, its ability to model deeply structured, non-obvious relationships that defy conventional flat-data systems.

This analysis is an invitation to reflect on the frameworks we use to shape our messaging – especially when we’re speaking to several audiences at once.

Everyone should be able to browse a post, skim a paragraph or two, and come away thinking, “This company is doing cool things.” A subset of readers should feel more than that.

Our client (“Company”) rejected the post based on an outline we submitted. It was too far afield. But in a saturated blogosphere where “graph for fraud detection” has become white noise, unfamiliarity might be exactly what cuts through. Let’s explore.

Company Background

- Stage and Funding: Company, with ~$30M in Series-A funding, was preparing for Series B, having two pilot customers, both Fortune-500, necessitating a focus on immediate traction. Company was arriving late – but with a platform more extensible than the incumbents.

- Market Landscape: The 2022 graph database – note graph db, as differentiated from the larger graph-computing landscape – market was dominated by firms like Neo4j, TigerGraph, Stardog, and ArangoDB. Those firms had strong branding in fraud detection, cybersecurity, and recommendation systems. Company’s extensible platform needed to stand out.

- Content Strategy: With 2–3 blog posts weekly, Company aimed to attract investors, journalists, analysts, customers, and jobseekers while expanding SEO. Limited pilot data constrained case studies, risking repetitive content. Company had already agreed to our recommendation of including employee profiles showing their artistic hobbies to attract new talent and show Company valued creative thinking.

- BMG Blog Post: Proposed to explore graph computing’s application to BMG’s amorphous structure, the post aimed to diversify content and position Company as a visionary, not in materials science but in designing a product that could solve a large class of problems faced by emerging tech.

The Decision

Company rejected the BMG post, prioritizing content aligned with their pilot customers and core markets. This conservative approach avoided alienating key audiences but missed opportunities to expand its audience and to demonstrate the product’s adaptability and extensibility.

Psychology of Content Marketing: Balancing Audiences

Content marketing must navigate a diverse audience with varying needs, from skimming executives to deep-reading engineers. Content must be universal acceptability – ensuring every reader, regardless of expertise, leaves with a positive impression (Company is doing interesting things) – while sparking curiosity or excitement in key subsets (e.g., customers, investors). Company’s audiences included:

- Technical Enthusiasts: Seek novel applications (e.g., BMG) to spark curiosity.

- Jobseekers: Attracted to innovative projects, enhancing talent pipelines.

- Analysts: Value enterprise fit, skimming technical details for authority.

- Investors: Prioritize traction and market size, wary of niche distractions.

- Customers: Demand ROI-driven solutions, less relevant to BMG.

- Journalists: Prefer relatable stories, potentially finding BMG too niche.

Strategic Analysis

Background on the graph word in 2022 will help with framing Company’s mindset. In 2017-2020, several cloud database firms had aliened developers with marketing content claiming their products would eliminate the need for coders. This strategic blunder stemmed from failure to manage messaging to a diverse audience. The blunder was potentially costly since coders are a critical group at the base of the sales funnel. Company’s rejection avoided this serious misstep but may have underplayed the value of engaging technology enthusiasts and futurists.

The graph database space was crowded. Company needed not only to differentiate their product but their category. Graph computing, graph AI, and graph analytics is a larger domain, but customers and analysists often missed the difference.

The proposed post cadence at the time, 3 to 5 posts per week, accelerated the risk of exhausting standard content categories. Incumbents like Neo4j had high post rates, further frustrating attempts to cover new aspects of the standard use cases.

Possible Rationale for Rejection and Our Responses

- Pilot Customer Focus:

- The small pilot base drove content toward fraud detection and customer 360 to ensure success and investor confidence. BMG’s niche focus risked diluting this narrative, potentially confusing investors about market focus.

- Response: Our already-high frequency of on-point posts (fraud detection, drug discovery, customer 360) combined with messaging on Company’s site ensures that an investor or analyst would unambiguously discern core focus.

- Crowded Market Dynamics:

- Incumbents owned core use cases, forcing Company to compete directly. BMG’s message was premature.

- Response: That incumbents owned core use cases is a reason to show that Company’s product was designed to handle those cases (accomplished with the majority of Company’s posts) but also had applicability beyond the crowded domains of core uses cases.

- Low ROI Potential:

- BMG targets a niche market with low value.

- Response: The BMG post, like corporate news posts and employee spotlights is not competing with core focus. It’s communicates something about Company’s minds, not its products.

- Audience Relevance:

- BMG might appeal to technical enthusiasts but is less relevant to customers and investors.

- Response: Journalists, feeling the staleness of graph db’s core messaging, might cover the BMG use case, thereby exposing Company to investors and analysts.

Missed Opportunities

- Content Diversification:

- High blog frequency risked repetitive content. BMG could have filled gaps, targeting long-tail keywords for future SEO growth.

- In 2025, materials science graph applications have grown, suggesting early thought leadership could have built brand equity.

- Thought Leadership:

- BMG positioned Company as a pioneer in emerging fields, appealing to analysts and investors seeking scalability.

- Engaging technical enthusiasts could have attracted jobseekers, addressing talent needs.

- Niche Market Potential:

- BMG’s relevance to aerospace and medical device R&D could have sparked pilot inquiries, diversifying customer pipelines.

- A small allocation of posts to niche but still technical topics could have balanced core focus without significant risk.

Decision Impact

- Short-Term: The rejection aligned with Company’s need to focus on the pilot and core markets, ensuring investor and customer confidence. The consequences were minimal, as BMG was unlikely to drive immediate high-value leads.

- Long-Term: A minor missed opportunity to establish thought leadership in a growing field, potentially enhancing SEO and investor appeal.

Lessons for Content Marketing Strategists

- Balance Universal Acceptability and Targeted Curiosity:

- Craft content that all audiences find acceptable (“This is interesting”) while sparking excitement in key groups (e.g., technical enthusiasts and futurists). Alienate no one.

- Understand the Value of Thought Leadership:

- Thought leadership shows that Company can connect knowledge to real-world problems in ways that engage and lead change.

- Align Content with Business Stage:

- Series-A startups prioritize traction, favoring core use cases. Company’s focus on financial services was pragmatic, but it potentially limited exposure.

- Later-stage companies can afford niche content for thought leadership, balancing short-term ROI with long-term vision.

- Navigate Crowded Markets:

- Late entrants must compete on established turf while differentiating. Company’s conservative approach competed with incumbents but missed a chance to reposition the conversation with visionary messaging.

- Niche content can carve unique positioning without abandoning core markets.

- Manage Content Cadence:

- High frequency (2–3 posts/week) requires diverse topics to avoid repetition. Allocate 80% to core use cases and 20% to niche topics to sustain engagement and SEO.

- Leverage Limited Data:

- With a small pilot base, anonymized metrics or hypothetical use cases can bolster credibility without revealing sensitive data. E.g., BMG simulations could serve this need.

- Company’s datasheets lacked evidential support, highlighting the need for creative proof points.

- SEO as a Long Game:

- Core use case keywords (e.g., “fraud detection”) drive immediate traffic, but keyword expansion builds future relevance.

- Company’s rejection of BMG missed early positioning in a growing field.

Conclusion

Company’s rejection of the BMG blog post was a defensible, low-impact decision driven by the desire to focus on a small pilot base and compete in a crowded 2022 graph database market. It missed a minor opportunity to diversify content, engage technical audiences, and establish thought leadership, both in general and in materials science – a field that had gained traction by 2025. A post like BMG wasn’t trying to generate leads from metallurgists. It was subtly, but unmistakably, saying: “We’re not just a graph database. We’re building the substrate for the next decade’s knowledge infrastructure.” That message is harder to convey when Company ties itself too tightly to existing use cases.

BMG was a concrete illustration that Company’s technology can handle problem spaces well outside the comfort zone of current incumbents. Where most vendors extend into new verticals by layering integrations or heuristics, the BMG post suggested that a graph-native architecture can generalize across domains not yet explored. The post showed breadth and demonstrated one aspect of transferability of success, exactly wat Series B investors say they’re looking for.

While not a critical mistake, this decision offers lessons for strategists and content marketers. It illustrates the challenge of balancing universal acceptability with targeted curiosity in a crowded market, where a late entrant must differentiate while proving traction. This analysis (mostly in outline form for quick reading) explores the psychology and nuances of the decision, providing a framework for crafting effective content strategies.

For content marketing strategists, the BMG post case study underscores the importance of balancing universal acceptability with targeted curiosity, aligning content with business stage, and leveraging niche topics to differentiate in crowded markets. By allocating a small portion of high-frequency content to exploratory posts, startups can maintain focus while planting seeds for future growth, ensuring all audiences leave with a positive impression and a few leave inspired.

Recent Comments